9 Simple Techniques For Home Equity Loan Canada

Table of ContentsThe Only Guide for Home Equity Loan CanadaThe Basic Principles Of Home Equity Loan Canada Not known Factual Statements About Home Equity Loan Canada Home Equity Loan Canada Can Be Fun For AnyoneNot known Details About Home Equity Loan Canada

The significant downside, nonetheless: You would certainly be putting your home on the line for an optional cost. This can be dangerous if you do not have a solid strategy to pay back the lending. It additionally adds rate of interest to an expense that really did not have interest to begin with, eventually costing you a lot more.If you require capital, you could be able to conserve money on passion by taking equity out of your home rather of taking out an organization funding.

A roi isn't ensured, and you're putting your residence on the line. It's possible to make use of home equity to purchase the stock exchange or purchase a rental residential or commercial property though both suggestions are high-risk and need significant treatment and factor to consider. A professional borrower could be able to take out a home equity lending on an investment property, too.

Some Known Details About Home Equity Loan Canada

Taking a trip can come with a steep rate tag, and tapping your home's equity might assist cover the expenses without having to enhance your credit score card debt. Even the finest trips do not last for life, though, and home equity debt can remain for years, so consider your decision carefully.

You need to itemize reductions on your tax obligation return, learn the facts here now and similar to the home mortgage deduction there are restrictions as to exactly how much you can subtract.

These can include numerous of the same closing prices as a typical actual estate closing, such as source, evaluation and debt report fees. HELOC lenders also usually bill annual charges to maintain the line open, as well as an early termination charge if you close it within three years of opening.

Home Equity Loan Canada Can Be Fun For Anyone

A home equity loan is a funding obtained on a home that currently has a main home loan. Your house serves as collateral for both the key home mortgage and the home equity car loan; failing to pay off either might result in the loss of the residential or commercial property. A home owner might think about obtaining a home equity look at more info financing if they need accessibility to a lump sum of money, however do not intend to market their home.

Similar to a regular home mortgage you'll need to apply and get approved for a home equity funding. Once approved, you'll receive a single lump-sum amount. You'll pay off the quantity with a fixed or variable interest rate over an established size of time, called a term. You're liable for making regular settlements on both your initial and bank loans simultaneously.

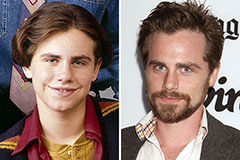

Rider Strong Then & Now!

Rider Strong Then & Now! Brian Bonsall Then & Now!

Brian Bonsall Then & Now! Alisan Porter Then & Now!

Alisan Porter Then & Now! Gia Lopez Then & Now!

Gia Lopez Then & Now! Elin Nordegren Then & Now!

Elin Nordegren Then & Now!